Sample Alerts and Reports

Trading Methods and Recent Sample Alerts

Sample Alerts and Methodology

SRP Swing Trade Parameters:

- We look first at the fundamentals of each company very closely. We drill down into the balance sheet, product lines, management, catalysts, share structures, SEC filings, financings, Price to Sales and Price to Earnings ratios, cash per share, and more to make sure we are looking only at quality names.

- Review of the sector the company or the 3xETF is in to look for sectors coming into favor or breaking out from consolidations

- Technical analysis review is then based on our human behavioral patterns, Elliott wave patterns, 13 and 34 day EMA lines, and base and post base pattern analysis.

- We set an objective for the trade and plan to hold for days to many weeks until we take profits on the way up, close it out, or get stopped out

- We only use stops near the close of market trading to avoid random stop loss runs and algo trading shake outs

- We usually sell 1/2 the position on the way up to lock in gains and reduce risk exposure, then hold the remainder a bit longer

This has resulted in a near 70% success rate with swing trades since our 9/1/13 Inception of SRP subscription service

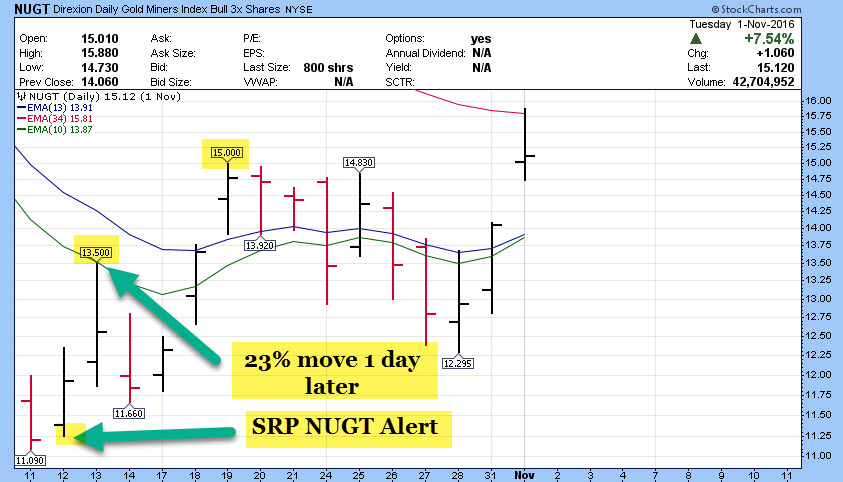

“Wow, well, you were right again! After you were right on the last two, I decided to go big on the next one. Up 70K since the alert yesterday. I should have followed the advice closer though, as I was more than happy with the 70K and sold everything at your “sell 1/2” alert. It’s starting to look like it will indeed run further with the strong close today. Thanks again, the service is worth the price alone just for the $NUGT alerts”

Todd G. – SRP Member

“I have to thank you. You guys are awesome. I have been moving in and out of sector funds in my 401k based on your information (biotech, gold). I sold my gold fund yesterday, a little early perhaps. But I am up 31.6% ytd. I went over 1 million in my plan and I am only 46! I have been telling my friends about you guys, hope to get you some new members as well as the help they need. Keep up the great work!”

Nick H. SRP Member

May 2017- 23% Gain in Swing Trade on TDOC- We sold at $30.50 after a huge reversal and run up from 22.73 Pivot

This video below shows the charts that we used over a few weeks as we updated our SRP Members on the anatomy of the trade.

Types of SRP Swing Trades:

3x ETF Bull or Bear – LABU, NUGT, ERX, ERY, DUST, LABD, EDC and more

Stocks- Focus is on fundamentals and technical’s and sector analysis combined

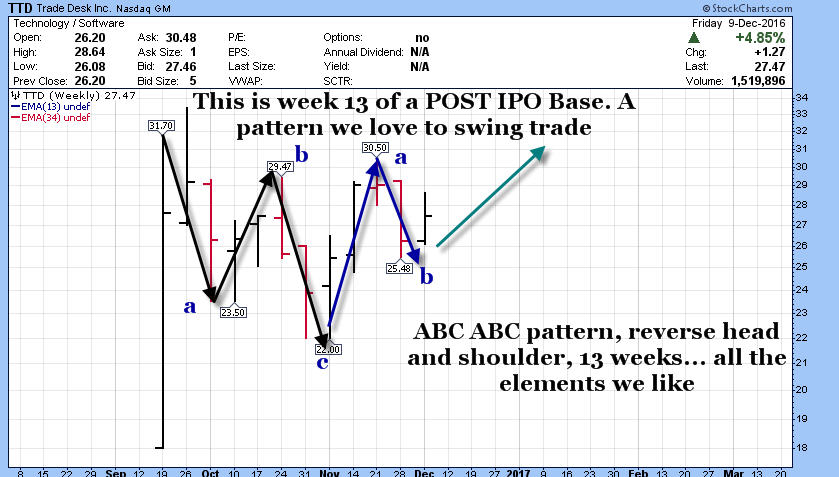

Post IPO Base- We look for 8, 13, 21 day or week base patterns on recent IPO’s for breakouts

Alerted via SMS Text, E-mail, and a full write up Post

Exit via SMS Text and Email

Morning reports daily on all positions

poshed at 15:27h

in

Sample Alerts

This trade resulted in a 21% move up the following morning as they crushed the earnings estimates. Based on our research and the 13 week pattern both, we went long into the earnings report. We do not often do that, but in this case felt...

poshed at 23:11h

in

Sample Alerts

Editors Note: This is a pre market morning report sample that we send out every day by 9am est

The Morning Report updates our SRP Members on the status of the SP 500, Gold, Oil, and other sectors such as Biotech. We also update all open...

poshed at 23:58h

in

Sample Alerts

Editors Note: This swing trade was up 31% within 3 weeks of the alert

YIN- Yintech Holdings- Near $17.25

10% Position Size- Fair Business value $25-$29, Target is $21 plus

A play on the Precious metals and commodities Bull and China

Yintech Investment Holdings Ltd. engages in the provision...

poshed at 21:32h

in

Sample Alerts

Dec 12th Alert- Editors Note: We saw a 19% move up in 24 hours on this one

NUGT ETF- 3x long Gold Stocks $11.60

5% Position size due to volatility/risk

Gold and Gold stocks have been slammed. We have not initiated a NUGT Trade since Pre- Brexit and...

poshed at 20:18h

in

Sample Alerts

Editors Note: This stock rallied to $44 per share in March of 2017, 12 weeks later for over a 50% move to the upside

TTD- The Trade Desk $27.47 12/9 Close

Recent IPO, 52 week high $33

Ranked the 55th fastest growing company in recent Deloitte Technology Fast...

poshed at 21:03h

in

Sample Alerts

May 25th 2016 Forecast Report- Editors Note, this was a Bullish Market call we made when everyone was bearish in Spring 2016.

We do Daily Pre-Market forecast updates on SP 500, Gold, Oil, Biotech and often other sectors as part of your SRP Membership.

There has...

poshed at 19:21h

in

Sample Alerts

SWHC- Smith and Wesson $19.66

The US Gun maker is not able to produce guns fast enough to meet demand.

This is reflected in the share price.

Now coming out of a 13 fibonacci week base with earnings due

We see this running to $23 per share from 19.50...