Swing Trade Alerts

3x ETF and Stock Swing Trades, Entry and Exit Alerts via SMS, E-mail and Post!

READ MORE

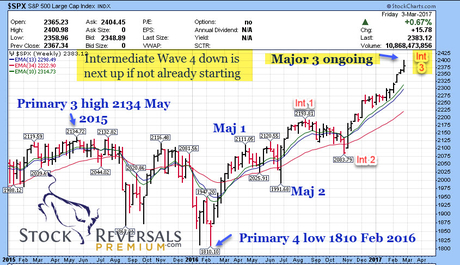

Short and Intermediate Forecasts of SP 500, Gold, Oil, Biotech and more!

Daily and Weekly Forecast Model Updates

READ MORE

Morning Reports

Pre-Market Strategy Reports, 3x ETF strategies, Entry and Exit planning and more!

See Sample

Testimonials

“I really believe you guys do a great job. I’m glad that I joined. It was worth the wait.”- G Harris, M.D.

READ MORE

A Subscription Service of The Market Analysts Group, LLC-

Swing Trading 3x ETF, Stocks, and ES Futures since 2009 with a twist!

The #1 Rated Stock Swing Trade service since 2009! Run by David Banister, Stocktwits Ambassador and Leader of two premium Swing Trading rooms on Stocktwits. Member since 2013 with over 3 million active users!

We combine Fundamental Analysis with Behavioral Based Technical Analysis to time entry and exits into profit making Swing Trades using 3x ETF’s, Post IPO Trading, and Human Behavioral Base pattern analysis.

🚀 Welcome Future Swing Trade Superstar! 🚀

Ready to stop second-guessing your trades and start locking in real profits? You’re in the right place.

📈 My proprietary Human Behavioral Pattern Swing Trade Method has delivered a 70% success rate since 2009 — and we’re still going strong!

🔥 Just this week, we closed out a 37% gain in under 7 days on APLD.

This is the kind of performance you deserve to see in your own trading!

💥 If you’re tired of:

-

Buying too late (or too early),

-

Selling too soon,

-

Spending hours analyzing without results…

Then it’s time to stop struggling and start winning.

👊 With my Premium Swing Trade Services, you get:

✅ Daily Trade Alerts

✅ Morning Market & Sector Forecasts

✅ Expert Guidance

✅ SMS Text + Email Notifications

✅ Member Posts & Commentary

✅ And a proven path to profits

🎯 Join now and tap into a trading system that actually works.

👉 Start Here to Profit »

Use code SAVE30 to save 30% and try us out!!

Not ready to take the premium service leap? Join the free weekly swing trade ideas list here

Review our 2 minute introductory Video on our services

Human Behavioral patterns are a key component to our success when we combine them with fundamental analysis, the results are stunning! Quite simply, we exploit investor weaknesses to spot ideal times to enter a stock or ETF and benefit from a bottoming reversal, consolidation, base pattern and other proprietary behavioral patterns we spot for members.

Dave,

Your skills are incredible and I thank you for what you do (and no idea how you have enough time and energy to do it all)! I didn’t realize you had multiple services and actually somehow thought I was signing up for SRP when I joined. Needless to say, with the performance of ENVX and CORZ since I joined, I’m thrilled I made the ‘mistake.’ That said, if you happen to have a coupon for SRP, I am very much inclined to join that service, too.

Thanks!

Bill R. 6/12/24 Email

JOIN TODAY FOR 25% OFF

JOIN TODAY FOR 25% OFF

SAVE25 Coupon Code : for 25% off Monthly, Quarterly or Annual options in the coupon field when joining. Coupon expires at end of week.

All Trading Results in all environments posted

Quick Details: Click to Review

Track Record of all closed trades through current 2024

Sample Alerts, Reports, Forecasts

Testimonials

FAQ’s

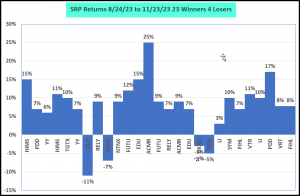

Recent Swing Trade Returns late 2023 all inclusive 23 winners 4 losers

PODCAST Interview from 2020 where Dave explains his methodology for consistently profitable swing trades in all environments. Dave discusses Behavioral Patterns, Fundamental analysis, position sizing and more in this 30 minute interview that really outlines what makes Dave different from other Advisors.

Click Image to listen

Swing Trading is not Day Trading nor Long Term Investing, its a pattern usually over as little as one day to as many as four to five weeks weeks trend. We look for price targets to be achieved, we sell 1/2 on the way up, and then close it out once the move is completed and or a stop is hit.

Dear Dave,

Thank you for all the amazing trades. I am in two of your services 3X and SRP. Both have done great for the year… you were the only one who predicted 4550 when everyone else was bearish. I’m glad I have followed you and traded well so far. Stephanie Y. – July 2023 unsolicited E-mail

All Closed out Swing Trades- Click below to review

Hi Dave-

“I belong to SRP and Tipping Point and just want to tell you I think you have the best service by far that I’ve ever come across. I not only make money from the trades but am learning to be more disciplined with your sell alerts and just learning in general from the reports about the stocks. So thank you :)”

Best,

Hi Dave-

“I belong to SRP and Tipping Point and just want to tell you I think you have the best service by far that I’ve ever come across. I not only make money from the trades but am learning to be more disciplined with your sell alerts and just learning in general from the reports about the stocks. So thank you :)”

Best,

Katya- Member

” Thanks for guiding us through this. You called this quite accurately. I am amazed how your market direction takes shape and coincides with real events. I won’t even ask how you do it!

Remember the below email from December 2018? You told me that a long term bottom would be around 2075. I am speechless, Dave! You should replace all the talking heads on CNBC!

Thanks again for always being so responsive and on the money!”

Bob- March 22nd 2020 (After Market Crash)

” Thanks for guiding us through this. You called this quite accurately. I am amazed how your market direction takes shape and coincides with real events. I won’t even ask how you do it!

Remember the below email from December 2018? You told me that a long term bottom would be around 2075. I am speechless, Dave! You should replace all the talking heads on CNBC!

Thanks again for always being so responsive and on the money!”

Bob- March 22nd 2020 (After Market Crash)

Our Chief Strategist Dave Banister, is one of only 25 Stocktwits.Com 3 million registered members with a Stocktwits premium trading room . These were closed in early 2024 as Stocktwits focused on online trading experiences for members and closed all rooms. These services are still in operation since 2018,2019 at The3xETFTrader.memberful.com

Our Chief Strategist Dave Banister, is one of only 25 Stocktwits.Com 3 million registered members with a Stocktwits premium trading room . These were closed in early 2024 as Stocktwits focused on online trading experiences for members and closed all rooms. These services are still in operation since 2018,2019 at The3xETFTrader.memberful.com

65,000 Traders follow our Chief Strategist on Stocktwits.com @stockreversals

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, One of Worlds Top Commodity Traders and Top 10 Follow on Twitter, CEO, Factor LLC

#1 Mention in this new book by Glenn Langhor on Stock Market Advisors to follow on the internet:

JOIN TODAY FOR 25% OFF

JOIN TODAY FOR 25% OFF

SAVE25 Coupon Code : for 25% off Monthly, Quarterly or Annual options in the coupon field when joining. Coupon expires at end of week.

SAMPLE Trade Alerts and Morning Report- Click Image to review samples

Premium Service Options: $99 per month, $249 for 90 days or save 36% with Annual $749

Use Coupon Code “SAVE25” when checking out to save 25% off all prices above today!

$749 Annually ($150 off temporarily, equivalent to $63 a month or the same cost as just 4 roundtrip Scottrade trades per month) (Less 25% when applying coupon code at checkout)

“I’ve never had the luxury of experiencing this kind of performance with a service. I’m highly enthused about what the next few months may bring. Love all your updates through the day and week, feels like I always know what we are expecting, and it gives me nice sense of security that you always have your eye on the ball.”

3x ETF, Post IPO Base, and Stock Trades for both Bull and Bear Cycles plus Market Forecast Models!

- SMS Text, E-mail, and Post on every Swing Trade

- Morning Updates every day pre-market with market forecast models updated

- Strategy and Education updates every morning

- 24/5 Access to Chief Strategist

- Stunning Track Record in all cycles since September 2013 inception

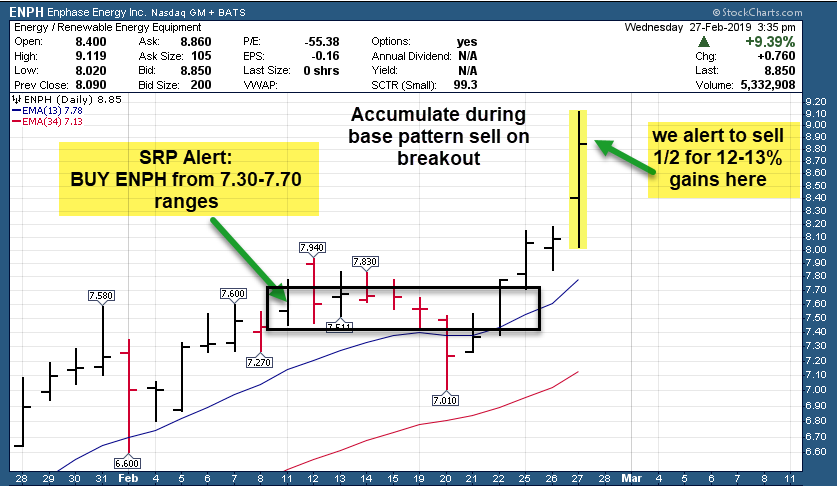

Base Patterns and POST IPO patterns are some of the big keys to

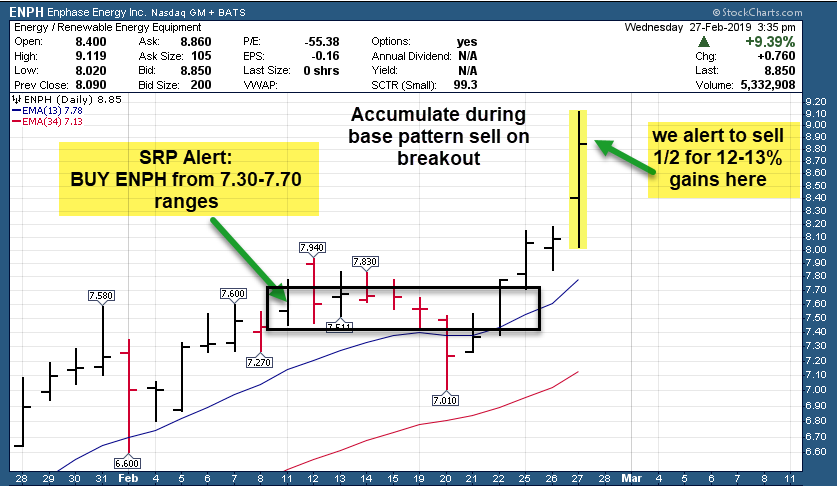

Base Patterns and POST IPO patterns are some of the big keys to #swingtrading success in the markets. Let the base play out before entering. Avoid dead money, grab the breakout and sell 1/2 on the way up. If the pattern breaks your stop is set where the pattern breaks down. We also exploit recent IPO’s as they are fresh to market participants and can generate fast moves. Many of these patterns are human behavioral based, and we exploit our secrets to enter just prior to big breakouts.

June 10th 2019, closing out 22% gainer in under 8 trading days on GH on a 13 week breakout

May 22nd 21% one day gain on SE after blowout earnings we projected!

12-13% gainer, on Feb 2019 Base Pattern Swing Trade ENPH: Breakout after base pattern accumulation, we then sell 1/2 for gains and raise the stop and hold the remainder.

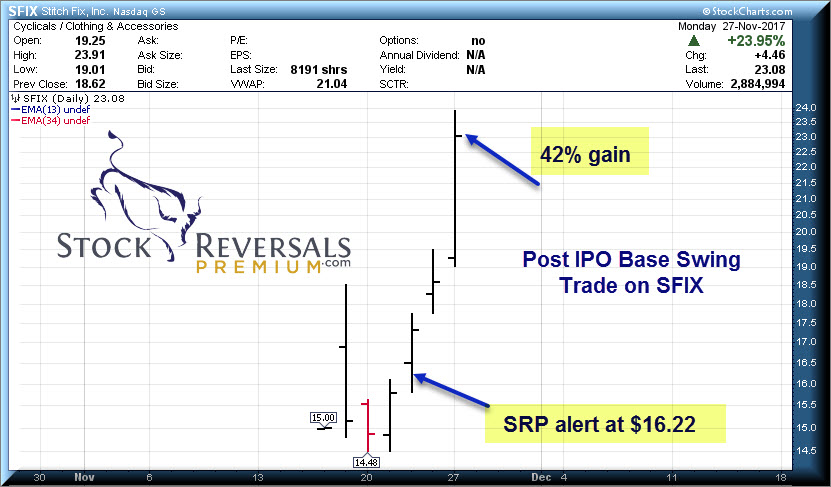

POST IPO Base plays: A consistent winner for SRP Swing Trade Members: We look for a pullback, consolidation of trend, or confusion amongst investors to exploit early weakness or base patterns ahead of the next move up.

POST IPO Base plays: A consistent winner for SRP Swing Trade Members: We look for a pullback, consolidation of trend, or confusion amongst investors to exploit early weakness or base patterns ahead of the next move up.

Recent Swing Trade POST IPO Gain of 35% on VIOT: April 2019

November 2017 42% 3 day gainer in SFIX- Another Post IPO Base play

We combine Fundamental analysis with Technical analysis to produce big winners. We provide a full write-up post with analysis and trade parameters on every position

In all of 2016, 2017, and 2018 we hit a combined 72% of our Swing Trades for profits. Why? We have a discipline that requires both a combination of Technical and Fundamental analysis. We mix in some Elliott Wave and Fibonacci work, and contrarian views. Less risk, better performance, like nothing you have ever seen- Dave, Chief Strategist

When do I buy? When do I sell? Is the stock about to reverse up or down?

When do I buy? When do I sell? Is the stock about to reverse up or down?

What should I buy? What should I avoid?

Do I take profits, or let it ride? Should I buy more or take a loss?

Where do I place my stop loss?

Which sectors should I be invested in? Which sectors should I avoid?

Where is the market going? What should my cash position size be?

We handle all of those worries for you daily… our Market Forecast models are stunning in their accuracy weeks in advance of tops and bottoms. When you combine our market road maps with our individual fundamental and technical analysis on our swing trades, its an amazing profit making combination!

“Increasingly, consumers are willing to pay for quality content. This is especially true of equity research, where the difference between a poor decision and a smart decision can directly impact an investor’s bottom line”. – George Moriarty, Seeking Alpha

“David, I found you on stocktwits and became a subscriber to your premium service (debating tipping point at the moment). You’ve proved to be invaluable and certainly hope to be half the trader you are. Thanks for what you do!” – Colin Lau SRP Member

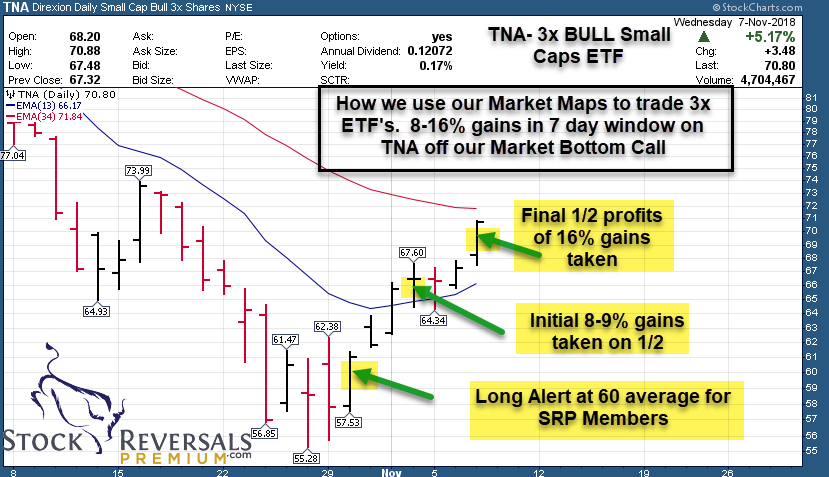

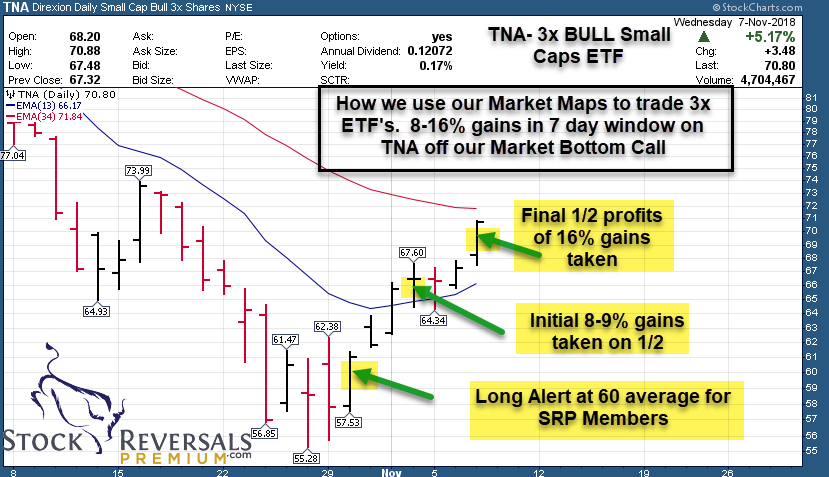

ETF Trading removes single stock risk, and allows us to play the Crowd Behavioral Bull and Bear patterns we identify in Small Caps, Biotech, and or other sectors like Semi-conductors etc.

We use 3x ETF for leverage to take 4% moves and turn them to 12% in our favor, either Bull or Bear.

TNA 3x ETF Trade for 16% Gains: ETF Trades are great to avoid single stock risk

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – Senior Vice President-Investments, Stifel-Nicolaus and Co. NYC- SRP Member

Are you ready for something new? Tired of poor performance?

Want to save time? Then get started!

Premium Service Options: $99 per month, $249 for 90 days or save 36% with Annual

$749 Annually ($150 off temporarily, equivalent to $63 a month or the same cost as just 4 roundtrip Scottrade trades per month)

3x ETF and Stock Trades for both Bull and Bear Cycles plus Market Forecast Models!

- Fundamentals and Technical’s combined for stunning swing trading results

- Morning pre market reports daily, SMS Text and Email for all buy and sell alerts, research on every position, charts updated regularly, guidance and education included!

- Stunningly accurate SP 500, Gold and Biotech Forecast models giving you major turns in advance!

SRP Members love the Morning Pre Market Report! Every day we update positions, strategies, and market forecast models with advice to start your day! SP 500, Gold, Biotech and more covered plus specific position notes and advice.

SRP Members love the Morning Pre Market Report! Every day we update positions, strategies, and market forecast models with advice to start your day! SP 500, Gold, Biotech and more covered plus specific position notes and advice.

“I’ve never had the luxury of experiencing this kind of performance with a service. I’m highly enthused about what the next few months may bring. Love all your updates through the day and week, feels like I always know what we are expecting, and it gives me nice sense of security that you always have your eye on the ball.”

-

- 1-3 New Swing Trades per Week depending on market conditions

-

- SMS Text, Email, and Full Post with details and research for all positions

-

- Specific Entry and Exit advice and alerts for all positions

-

- Morning pre-market reports on Indexes, Positions, and Strategy planning daily

- Stunningly accurate SP 500 and Gold forecasts updated daily

Hello Dave!

It’s the second month since I joined your service and I really have no words for the quality and the great results of your research!My account has already increased but the important thing is how smoothly and with no stress at all this has been achieved!I consider myself a lifetime member and I will soon update to a yearly membership!

I will definitely dedicate much more money to your recommendations because the quality is more than obvious and especially this week was awesome!!

Just wanted to thank you for what you are doing!

Kind regards,

Bill L. SRP Member

“I am glad I am a subscriber. Your analysis gives me the confidence to invest more aggressively than I would on my own. I have blown away the markets averages for this year. Your analysis increases my odds. Thanks again!” SRP Member Nick H.

SUBSCRIPTION DETAILS

Our SRP Subscription Membership provides our members with Active 3x ETF & Stock Swing Trades, Daily and Weekly Market and Sector Forecasts, Morning Pre-Market reports, Trader Education, Investing Strategies, all with SMS Text, Email, and Post alerts with entry and exit advice.

You will become a better trader, earn more income, take less risk, and learn to think contrarian!

If you are ready to learn a different method of beating the market with less risk, probably much different than what you have been doing, then read up and consider joining.

TEMPORARY NEW PRICING! $749 ANNUAL OPTION SAVES $450/YR vs monthly!

$150 OFF $899 GOOD FOR SHORT PERIOD OF TIME ONLY

Join Monthly at $99, Quarterly at $249 (Save 17%), or Annually at $749 (Save 36%)

SIGN UP

TRACK RECORD

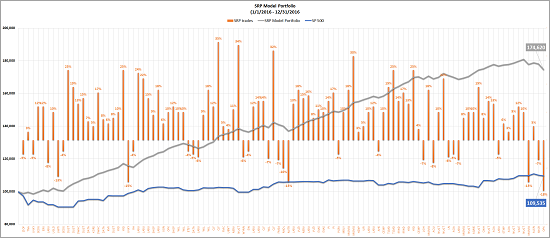

SRP Members have witnessed a track record which has outperformed the SP 500 Index over 12 to 1 since inception in September 2013 and we list our entire track record of closed out trades on the website, updated quarterly.

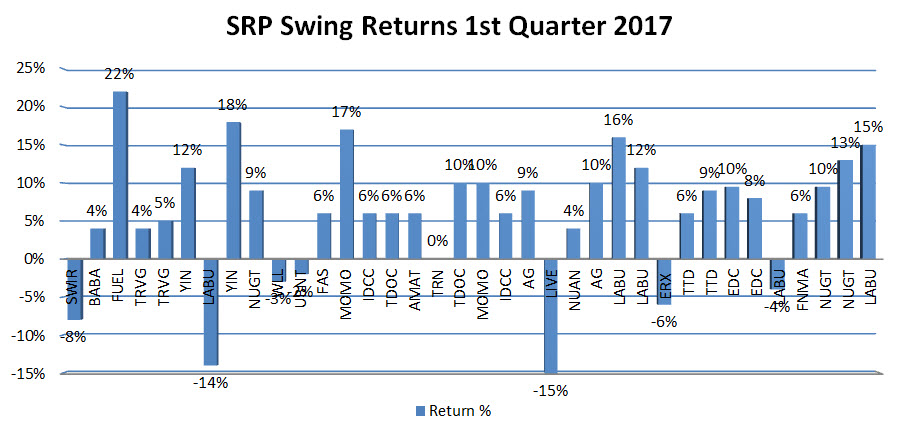

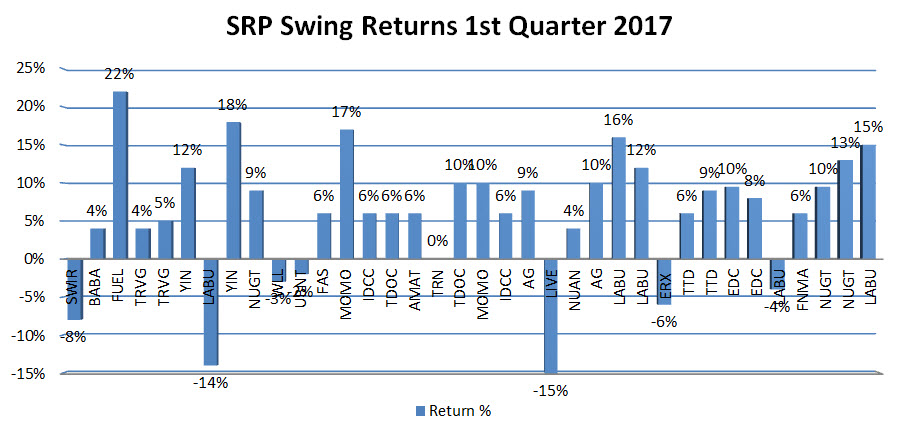

1st quarter 2017 31 Winners and only 7 losers. An 81% win rate for our members!

Since September 2013 Inception we have averaged 70% of our swing trade closing out for profits!

More importantly we try to keep our losses contained to 3-7% in most cases when we were wrong and some of our winners were significant gainers.

We have highlighted each of the last several quarters of Closed out swing trades at SRP. We have outperformed the SP 500 Index well over 12 to 1 since 9/1/13 inception.

READ MORE

TESTIMONIALS

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – Senior Vice President-Investments, Stifel-Nicolaus and Co. NYC – SRP Member

“Just wanted you to know I am having a great deal of success using your premium service. It is having a radically positive impact on my 401k. Your service is truly remarkable and will have a huge impact on our financial future. Thanks.”

Doug Klein – SRP Member

“I couldn’t be happier with your services and professionalism. I’m blown away by your response time and even more so, how simple and easy you made this process. I continue to only speak the highest of SRP. You’re great. Thanks again, Dave”

Steven – SRP Member

“Crazy amazing how you are nailing the market!! Just so impressive!!!! I tell everyone about you. Hey, if they are smart enough and need direction then they’ll join!”

Jacqueline R. – SRP Member

READ MORE

SAMPLE ALERTS

Sample LABU (3x ETF) Trade Result:

Review a few of our Sample SRP Member alerts:

- We typically provide an entry range, target objective, stop loss near market close

- Ongoing daily guidance on every position

- We aim for 7-20% gains on every swing position

- We focus on fundamentals and technical patterns both

- The aim is for low risk entry points and high upside for risk-reward

READ MORE

A Subscription Service of The Market Analysts Group, LLC-

Swing Trading 3x ETF, Stocks, and ES Futures since 2009 with a twist!

The #1 Rated Stock Swing Trade service since 2009! Run by David Banister, Stocktwits Ambassador and Leader of two premium Swing Trading rooms on Stocktwits. Member since 2013 with over 3 million active users!

We combine Fundamental Analysis with Behavioral Based Technical Analysis to time entry and exits into profit making Swing Trades using 3x ETF’s, Post IPO Trading, and Human Behavioral Base pattern analysis.

🚀 Welcome Future Swing Trade Superstar! 🚀

Ready to stop second-guessing your trades and start locking in real profits? You’re in the right place.

📈 My proprietary Human Behavioral Pattern Swing Trade Method has delivered a 70% success rate since 2009 — and we’re still going strong!

🔥 Just this week, we closed out a 37% gain in under 7 days on APLD.

This is the kind of performance you deserve to see in your own trading!

💥 If you’re tired of:

-

Buying too late (or too early),

-

Selling too soon,

-

Spending hours analyzing without results…

Then it’s time to stop struggling and start winning.

👊 With my Premium Swing Trade Services, you get:

✅ Daily Trade Alerts

✅ Morning Market & Sector Forecasts

✅ Expert Guidance

✅ SMS Text + Email Notifications

✅ Member Posts & Commentary

✅ And a proven path to profits

🎯 Join now and tap into a trading system that actually works.

👉 Start Here to Profit »

Use code SAVE30 to save 30% and try us out!!

Not ready to take the premium service leap? Join the free weekly swing trade ideas list here

Review our 2 minute introductory Video on our services

Human Behavioral patterns are a key component to our success when we combine them with fundamental analysis, the results are stunning! Quite simply, we exploit investor weaknesses to spot ideal times to enter a stock or ETF and benefit from a bottoming reversal, consolidation, base pattern and other proprietary behavioral patterns we spot for members.

JOIN TODAY FOR 25% OFF

JOIN TODAY FOR 25% OFF

SAVE25 Coupon Code : for 25% off Monthly, Quarterly or Annual options in the coupon field when joining. Coupon expires at end of week.

All Trading Results in all environments posted

Quick Details: Click to Review

Track Record of all closed trades through current 2024

Sample Alerts, Reports, Forecasts

Testimonials

FAQ’s

Recent Swing Trade Returns late 2023 all inclusive 23 winners 4 losers

PODCAST Interview from 2020 where Dave explains his methodology for consistently profitable swing trades in all environments. Dave discusses Behavioral Patterns, Fundamental analysis, position sizing and more in this 30 minute interview that really outlines what makes Dave different from other Advisors.

Click Image to listen

Swing Trading is not Day Trading nor Long Term Investing, its a pattern usually over as little as one day to as many as four to five weeks weeks trend. We look for price targets to be achieved, we sell 1/2 on the way up, and then close it out once the move is completed and or a stop is hit.

Dear Dave,Thank you for all the amazing trades. I am in two of your services 3X and SRP. Both have done great for the year… you were the only one who predicted 4550 when everyone else was bearish. I’m glad I have followed you and traded well so far. Stephanie Y. – July 2023 unsolicited E-mail

All Closed out Swing Trades- Click below to review

Hi Dave-“I belong to SRP and Tipping Point and just want to tell you I think you have the best service by far that I’ve ever come across. I not only make money from the trades but am learning to be more disciplined with your sell alerts and just learning in general from the reports about the stocks. So thank you :)”Best,Katya- Member

” Thanks for guiding us through this. You called this quite accurately. I am amazed how your market direction takes shape and coincides with real events. I won’t even ask how you do it!

Remember the below email from December 2018? You told me that a long term bottom would be around 2075. I am speechless, Dave! You should replace all the talking heads on CNBC!Thanks again for always being so responsive and on the money!”Bob- March 22nd 2020 (After Market Crash)

Our Chief Strategist Dave Banister, is one of only 25 Stocktwits.Com 3 million registered members with a Stocktwits premium trading room . These were closed in early 2024 as Stocktwits focused on online trading experiences for members and closed all rooms. These services are still in operation since 2018,2019 at The3xETFTrader.memberful.com

Our Chief Strategist Dave Banister, is one of only 25 Stocktwits.Com 3 million registered members with a Stocktwits premium trading room . These were closed in early 2024 as Stocktwits focused on online trading experiences for members and closed all rooms. These services are still in operation since 2018,2019 at The3xETFTrader.memberful.com

65,000 Traders follow our Chief Strategist on Stocktwits.com @stockreversals

“David, you are, without a doubt, one of the best if not the best Elliott Wave guys I am aware of” 8/30/17

Peter Brandt, One of Worlds Top Commodity Traders and Top 10 Follow on Twitter, CEO, Factor LLC

#1 Mention in this new book by Glenn Langhor on Stock Market Advisors to follow on the internet:

JOIN TODAY FOR 25% OFF

JOIN TODAY FOR 25% OFF

SAVE25 Coupon Code : for 25% off Monthly, Quarterly or Annual options in the coupon field when joining. Coupon expires at end of week.

SAMPLE Trade Alerts and Morning Report- Click Image to review samples

$749 Annually ($150 off temporarily, equivalent to $63 a month or the same cost as just 4 roundtrip Scottrade trades per month) (Less 25% when applying coupon code at checkout)

“I’ve never had the luxury of experiencing this kind of performance with a service. I’m highly enthused about what the next few months may bring. Love all your updates through the day and week, feels like I always know what we are expecting, and it gives me nice sense of security that you always have your eye on the ball.”

3x ETF, Post IPO Base, and Stock Trades for both Bull and Bear Cycles plus Market Forecast Models!

- SMS Text, E-mail, and Post on every Swing Trade

- Morning Updates every day pre-market with market forecast models updated

- Strategy and Education updates every morning

- 24/5 Access to Chief Strategist

- Stunning Track Record in all cycles since September 2013 inception

Base Patterns and POST IPO patterns are some of the big keys to

Base Patterns and POST IPO patterns are some of the big keys to #swingtrading success in the markets. Let the base play out before entering. Avoid dead money, grab the breakout and sell 1/2 on the way up. If the pattern breaks your stop is set where the pattern breaks down. We also exploit recent IPO’s as they are fresh to market participants and can generate fast moves. Many of these patterns are human behavioral based, and we exploit our secrets to enter just prior to big breakouts.

June 10th 2019, closing out 22% gainer in under 8 trading days on GH on a 13 week breakout

May 22nd 21% one day gain on SE after blowout earnings we projected!

12-13% gainer, on Feb 2019 Base Pattern Swing Trade ENPH: Breakout after base pattern accumulation, we then sell 1/2 for gains and raise the stop and hold the remainder.

POST IPO Base plays: A consistent winner for SRP Swing Trade Members: We look for a pullback, consolidation of trend, or confusion amongst investors to exploit early weakness or base patterns ahead of the next move up.

POST IPO Base plays: A consistent winner for SRP Swing Trade Members: We look for a pullback, consolidation of trend, or confusion amongst investors to exploit early weakness or base patterns ahead of the next move up.

Recent Swing Trade POST IPO Gain of 35% on VIOT: April 2019

November 2017 42% 3 day gainer in SFIX- Another Post IPO Base play

We combine Fundamental analysis with Technical analysis to produce big winners. We provide a full write-up post with analysis and trade parameters on every position

In all of 2016, 2017, and 2018 we hit a combined 72% of our Swing Trades for profits. Why? We have a discipline that requires both a combination of Technical and Fundamental analysis. We mix in some Elliott Wave and Fibonacci work, and contrarian views. Less risk, better performance, like nothing you have ever seen- Dave, Chief Strategist

When do I buy? When do I sell? Is the stock about to reverse up or down?

When do I buy? When do I sell? Is the stock about to reverse up or down?

What should I buy? What should I avoid?

Do I take profits, or let it ride? Should I buy more or take a loss?

Where do I place my stop loss?

Which sectors should I be invested in? Which sectors should I avoid?

Where is the market going? What should my cash position size be?

We handle all of those worries for you daily… our Market Forecast models are stunning in their accuracy weeks in advance of tops and bottoms. When you combine our market road maps with our individual fundamental and technical analysis on our swing trades, its an amazing profit making combination!

“Increasingly, consumers are willing to pay for quality content. This is especially true of equity research, where the difference between a poor decision and a smart decision can directly impact an investor’s bottom line”. – George Moriarty, Seeking Alpha

“David, I found you on stocktwits and became a subscriber to your premium service (debating tipping point at the moment). You’ve proved to be invaluable and certainly hope to be half the trader you are. Thanks for what you do!” – Colin Lau SRP Member

ETF Trading removes single stock risk, and allows us to play the Crowd Behavioral Bull and Bear patterns we identify in Small Caps, Biotech, and or other sectors like Semi-conductors etc.

We use 3x ETF for leverage to take 4% moves and turn them to 12% in our favor, either Bull or Bear.

TNA 3x ETF Trade for 16% Gains: ETF Trades are great to avoid single stock risk

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – Senior Vice President-Investments, Stifel-Nicolaus and Co. NYC- SRP Member

Are you ready for something new? Tired of poor performance?

Want to save time? Then get started!

$749 Annually ($150 off temporarily, equivalent to $63 a month or the same cost as just 4 roundtrip Scottrade trades per month)

3x ETF and Stock Trades for both Bull and Bear Cycles plus Market Forecast Models!

- Fundamentals and Technical’s combined for stunning swing trading results

- Morning pre market reports daily, SMS Text and Email for all buy and sell alerts, research on every position, charts updated regularly, guidance and education included!

- Stunningly accurate SP 500, Gold and Biotech Forecast models giving you major turns in advance!

SRP Members love the Morning Pre Market Report! Every day we update positions, strategies, and market forecast models with advice to start your day! SP 500, Gold, Biotech and more covered plus specific position notes and advice.

SRP Members love the Morning Pre Market Report! Every day we update positions, strategies, and market forecast models with advice to start your day! SP 500, Gold, Biotech and more covered plus specific position notes and advice.

“I’ve never had the luxury of experiencing this kind of performance with a service. I’m highly enthused about what the next few months may bring. Love all your updates through the day and week, feels like I always know what we are expecting, and it gives me nice sense of security that you always have your eye on the ball.”

-

- 1-3 New Swing Trades per Week depending on market conditions

-

- SMS Text, Email, and Full Post with details and research for all positions

-

- Specific Entry and Exit advice and alerts for all positions

-

- Morning pre-market reports on Indexes, Positions, and Strategy planning daily

- Stunningly accurate SP 500 and Gold forecasts updated daily

“I am glad I am a subscriber. Your analysis gives me the confidence to invest more aggressively than I would on my own. I have blown away the markets averages for this year. Your analysis increases my odds. Thanks again!” SRP Member Nick H.

SUBSCRIPTION DETAILS

Our SRP Subscription Membership provides our members with Active 3x ETF & Stock Swing Trades, Daily and Weekly Market and Sector Forecasts, Morning Pre-Market reports, Trader Education, Investing Strategies, all with SMS Text, Email, and Post alerts with entry and exit advice.

You will become a better trader, earn more income, take less risk, and learn to think contrarian!

If you are ready to learn a different method of beating the market with less risk, probably much different than what you have been doing, then read up and consider joining.

TEMPORARY NEW PRICING! $749 ANNUAL OPTION SAVES $450/YR vs monthly!

$150 OFF $899 GOOD FOR SHORT PERIOD OF TIME ONLY

Join Monthly at $99, Quarterly at $249 (Save 17%), or Annually at $749 (Save 36%)

TRACK RECORD

SRP Members have witnessed a track record which has outperformed the SP 500 Index over 12 to 1 since inception in September 2013 and we list our entire track record of closed out trades on the website, updated quarterly.

1st quarter 2017 31 Winners and only 7 losers. An 81% win rate for our members!

Since September 2013 Inception we have averaged 70% of our swing trade closing out for profits!

More importantly we try to keep our losses contained to 3-7% in most cases when we were wrong and some of our winners were significant gainers.

We have highlighted each of the last several quarters of Closed out swing trades at SRP. We have outperformed the SP 500 Index well over 12 to 1 since 9/1/13 inception.

TESTIMONIALS

“I really like what you’re doing (and it’s not just because you’re on a hot streak right now). I feel like you have the whole package – solid fundamental and technical expertise – combined with a very realistic grip on trading psychology.” A.W. – Senior Vice President-Investments, Stifel-Nicolaus and Co. NYC – SRP Member

“Just wanted you to know I am having a great deal of success using your premium service. It is having a radically positive impact on my 401k. Your service is truly remarkable and will have a huge impact on our financial future. Thanks.”

Doug Klein – SRP Member

“I couldn’t be happier with your services and professionalism. I’m blown away by your response time and even more so, how simple and easy you made this process. I continue to only speak the highest of SRP. You’re great. Thanks again, Dave”

Steven – SRP Member

“Crazy amazing how you are nailing the market!! Just so impressive!!!! I tell everyone about you. Hey, if they are smart enough and need direction then they’ll join!”

Jacqueline R. – SRP Member

SAMPLE ALERTS

Sample LABU (3x ETF) Trade Result:

Review a few of our Sample SRP Member alerts:

- We typically provide an entry range, target objective, stop loss near market close

- Ongoing daily guidance on every position

- We aim for 7-20% gains on every swing position

- We focus on fundamentals and technical patterns both

- The aim is for low risk entry points and high upside for risk-reward