29 Nov TPS Buy Report- EXPI- eXp World holdings

EXPI- eXp World Holdings Inc. $6.44 as of 11/27/17 close

52 Million Shares Outstanding, Market Cap 335 Million

“First Mover advantage and the fastest growing cloud based Real Estate Brokerage in the United States. Under the radar but not for long”-Dave

13 Month Targets $13.30 to $26 for 120% to 300% Gains (Possible quadruple)

- 74% of shares controlled by Insiders, 70% by top two shareholders and founders:

- Glenn Sanford- CEO, Founder- Owns 21 million shares of 52 Million outstanding

- Penny Sanford- Owns 17 Million shares

eXp World Holdings, Inc. (OTCQB: EXPI) is the holding company for a number of companies most notably eXp Realty LLC, the Agent-Owned Cloud Brokerage®. As a full-service real estate brokerage, eXp Realty LLC provides 24/7 access to collaborative tools, training, and socialization for real estate brokers and agents through its 3-D, fully-immersive, cloud office environment. eXp Realty, LLC and eXp Realty of Canada, Inc. also feature an aggressive revenue sharing program that pays agents a percentage of gross commission income earned by fellow real estate professionals who they attract into the Company.

Investor Presentation (PDF) Suggested reading

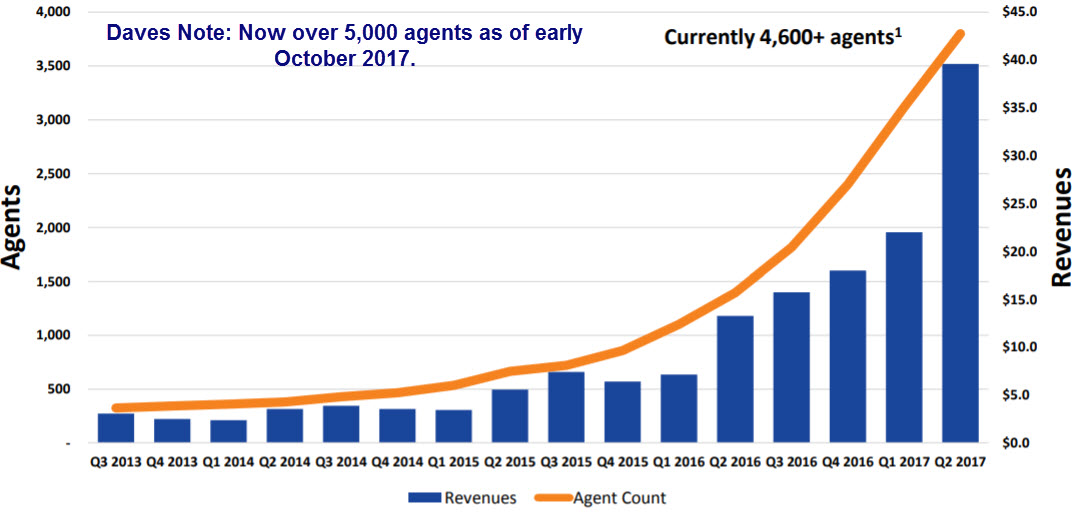

- A recent 200% year over year growth rate

- Cloud Based Real Estate Brokerage

- First mover advantage

- Strong growth, growing at 5x the rate of Redfin (RDFN- 2017 IPO)

- Under the radar

- High insider ownership of 74%

- Cash flow positive

- Presenting at LD Micro Cap Conference in LA next week

- At a Tipping Point

OTC Market – Thinly traded stock, use limit orders when accumulating if possible.

Up-Listing to a major exchange (NASDAQ) likely in 1st quarter 2018, have met all requirements for listing. Once up listed we expect analyst coverage, more volume, and a much higher share price.

EXP is reinventing the real estate model by exiting the traditional real estate brick-and-mortar operation, and maximizing agent-ownership, commissions to agents, with virtual reality based training, internal agent customer services and a virtual campus using the latest in technology. EXP is doing this while at the same time while having a cash flow positive business, investing in new employees and technology, and growing at a 200% clip. In addition, we find the management team very shareholder friendly as they are not diluting the stock at all nor do they really need to raise capital at this time and they control 74% of the shares.

Currently operating in 44 U.S. States + D.C. & Alberta, Canada with over 5,000 agents as of October 1st, up from 2400 at the start of 2017.

As the business model and word has begun to spread to real estate agents, we think this company is now at a Tipping Point of growth both as a business and we think in the next few quarters the stock price will make a large leap to account for it.- Dave, Chief Strategist

Agents are flocking to the platform according to Greg Falesnick of MZ Capital, whom we spoke with on the phone. (MZ is acting as the contact for Investor Relations and spent months doing due diligence before taking on EXPI as a client last year.) According to Falesnick, EXPI is now grown to the #6 or #7 Real Estate Brokerage in the USA. The analysts told us that 4 of the top 10 Keller Williams offices in the country have joined and are embracing this platform. We believe other agencies from various brokerages will follow and EXPI has first mover advantage and a technology lead that would take some time for other slow movers to catch up to if at all.

What is all the buzz about and why is the stock still very undervalued on a 12 month forward looking basis?

Most traditional brokerages continue to allocate significant resources to physical bricks and mortar and all of the ancillary costs associated with it – including utility, insurance, rent, CAM, furnishings, and staffing costs – forcing a downward pressure on profits. EXPI is going a different direction and should benefit shareholders and agents both long term. The model is attractive to the top agents as they have more incentive to help not only their own potential income with higher commission rates and lower fees, but also to participate as a shareholder in the company at the same time.

Growth: 200% revenue growth year over year. Agent growth exploding year over year.

In the most recently reported quarter:

Revenue increased 203% to a record $48.1 million in the most recently reported quarter year over year. Record cash flow of $3.3 million, an increase of 255% year-over-year. Record real estate agent count increase of 173% year-over-year, surpassing 5,000 agents in early October. We are modeling 9,000-12,000 by end of 2018.

This company is flying well under the radar, save for a Seeking Alpha article that did in fact push the shares from $3 to $6 in October. Near the bottom of this report we make the argument here that the market cap in 12-13 months could be much highern. In fact, we can see $13.30-$26 per share for 120%-330% potential gains based on our model. Our model allows for EXPI just to catch up to the valuation metrics afforded to Redfin (RDFN) which went public this year and trades at 3x sales with slower growth and is not profitable nor even close.

Technology and Platform:

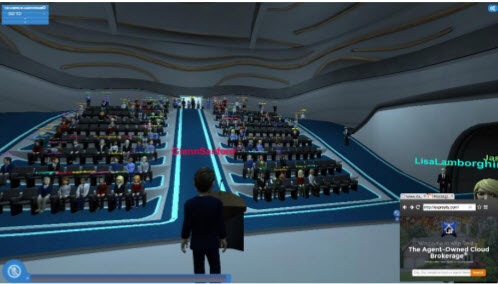

EXPI Virtual World:

eXp Agents across the United States and Canada are using the first ever 3-D, fully immersive cloud-brokerage to meet colleagues, share tips, attend classes, and build strategies for taking their business to the next level. Essentially a virtual reality world and campus for trading and agent support services. You design your own gravitar online and you literally can talk or text to support staff, other agents, sit in meetings, collaborate and more. The platform is unlike any other in the industry.

eXp Realty’s exponential growth signifies a shift in what agents and teams consider when choosing a brokerage. No longer is a physical office the best way to build community with other agents and clients. Now, agents have the ability to work in the cloud to collaborate, market their own brand and be part of redefining the real estate brokerage value proposition. As the only cloud-based real estate brokerage, eXp Realty is transforming real estate experience by allowing agents to defy distance in where and with whom they work, and establish direct ownership in the company while earning additional income for helping the company grow.- Company Website

Compensation: High commission split, low caps, low fees

eXp offers every agent an alternative share-based compensation structure that makes the Cloud Brokerage truly “agent-owned”.

Agents receive an 80/20 split on first $80,000 gross commission income (GCI) with $16,000 yearly cap paid out to eXp (20% of $80,000) . Agents keep 100% of the commission for the

remainder of their respective commission year, just paying basic per transaction fees etc.

Agents are compensated at a higher commision split level than traditional brokerages, and with opportunity to participate in the growth of the company via EXPI stock. As they close transactions they are allocated shares with each transaction and also can receive shares for bringing on new agents who close transactions as well. Once they hit a certain level of commission, they move up to full commissions with no split and then just pay transaction and basic agent fees. This keeps the agents tied to the performance and profitability of EXPI long term and makes them much less like to jump ship to another agency or brokerage. Higher retention means more profits and stronger growth which means higher share price long term.

In addition, 36% of the Agents are taking 5% of their commissions in company stock, further tieing them to the platform.

Product Expansion:

The company aims to selectively add Title Insurance and Closing and other services in certain markets in the next few quarters. This will be an option for the existing EXP Agents to offer their clients and will add over time incremental revenues that are in addition to our models. The thinking here based on our conversation with CEO and Founder Glenn Sanford, is over time there can be much more revenue on a per agent basis. We believe this makes sense because the agents are shareholders in EXPI and therefore it behooves them to recommend company services as opposed to out sourcing them. We also know agents do tend to have existing business relationships in many cases, but we can see an incentive to push certain closing, escrow, title and other services towards EXPI. This could be a meaningful revenue expander in the coming few years and is not in our current model. Sanford is looking to roll this out in selected markets in 2018 as regulations allow.

Stock Market recognition coming?: NASDAQ Up listing in 2018 likely 1st quarter

William Blair is already covering the company even though they are not yet on a Major Exchange, this alone is pretty impressive and very rare.

As part of our research we spoke at length a few times with Greg Falesnick, of MZ Group, a global investor relations firm. The company has now met all of the requirements for an up listing to a major exchange, likely to the NASDAQ. We believe this could happen as early as the first quarter of 2018. The CEO Glenn Sanford also seemed to indicate that the wheels are turning towards the up listing already. The typical turnaround time from the submission of official paperwork is about six weeks. The clock may be already ticking here or soon will be.

We want to accumulate the stock now before this occurs as we expect trading volume to expand dramatically along with investor recognition and later analyst coverage. Once this occurs the stock becomes eligible for institutions to purchase, they will likely be able to raise capital easily to expand, and other platforms like Stocktwits will list the stock in message boards which again expands the reach. With a current small float of only 14 million shares, the recipe for investor recognition and a sharp move up in share price in 2018 should be in the cards.

Valuation: 110% to 322% gains possible in 12-15 months- Value of $13.30 to $26 up from $6.30

We are going to draw comparison to Redfin (RDFN) which went public this year. Redfin is growing at about a 38% annual clip in terms of revenues compared to a recent 200% for EXPI. RDFN is nowhere near profitable and does not have the same agent platform as EXPI let alone the technology advantage. RDFN currently trades at a price to revenue ratio of about 3x.

We are extrapolating that by the end of 2018 EXPI could have in the neighborhood of 9,000 agents at the current run rate of agents joining or about 330 per month. However, we think the viral nature of more agents bringing on more agents could expand the growth to about 12,000 by the end of 2018 from 5,000 as of early October if not possibly higher. Falesnick felt our model of 9,000 is likely very conservative and 12,000 is quite reasonable to model out in our work.

According to Falesnick, the company turns very profitable once they hit the 7,500 agent threshold which could occur by April 2018 according to him. As it stands now, they are cash flow positive and plowing back all money into the growth of the platform and business.

Extrapolating revenues per agent at roughly $10,000 per agent per quarter times 12,000 agents would project 120 million in revenues alone in the 4th quarter of 2018 up from 48 million in the recently reported third quarter of 2017. This would put an annualized run rate of revenues at 480 million, multiply by 3x and we have a market cap projection of 1.44 Billion or $26 per share assuming 54 Million shares.

Even if we take a price to revenue multiple of 2x, we come up with $17.75 per share target for end of 2018 on a model of 12,000 agents. If we back this down to 9,000 agents which we find to be very conservative, we are still at $20 per share at 3x revenue. Taking it more conservatively, 9,000 agents and using 2x revenue multiple would be $13.33 per share, still over 100% potential.

There is upside to our model if the Agent count is higher than 12,000 which is clearly possible, the price to sales multiple is higher due to the growth rate, or if over time the ancillary services segment out-performs expectations.

Certainly as the company gains exposure we could see them as a buyout candidate for a larger company, although we do not believe the founders are looking to sell. Sanford indicated to us he is looking to build a legacy for his family.

Buy Advice: 5 week base could break out soon

The one caution flag we will throw here is because they are listed on the OTC Currently, the bid and ask spread can be wide. You want to try to use “Limit” buy orders, scattered around at various prices up to a maximum $7.25 as you accumulate shares. Also, the volume right now is not that high so the stock can move quickly. This is common with emerging growth stocks that we find and recommend, but again we expect volume and share price to eventually move up strongly as they get listed on the NASDAQ and likely see more Analyst and or newsletter type coverage at some point as well.

We are comfortable paying up to $7.25 per share which is the recent high before a pullback. We expect that area to get challenged again anyways. One more article on Seeking Alpha or elsewhere or an advisory service picking up the story and this is at $10 or higher we think.

Accumulate from $6.10 to $7.25 is our suggestion. We expect again this stock should on the conservative side be looking at $13.30 per share in 12-13 months and $26 on the higher end is possible.

At $13.30 we are forecasting an 83% gain in 12 months from a max entry of $7.25, certainly qualifying for TPS objectives of 50-200% gains in 9-18 months. At $26 we can see 258% gains or more than a triple from $7.25 max entry if we hit the high end of growth and P/S ratios.

We actually feel a fair value right now is around $12 per share for what its worth.