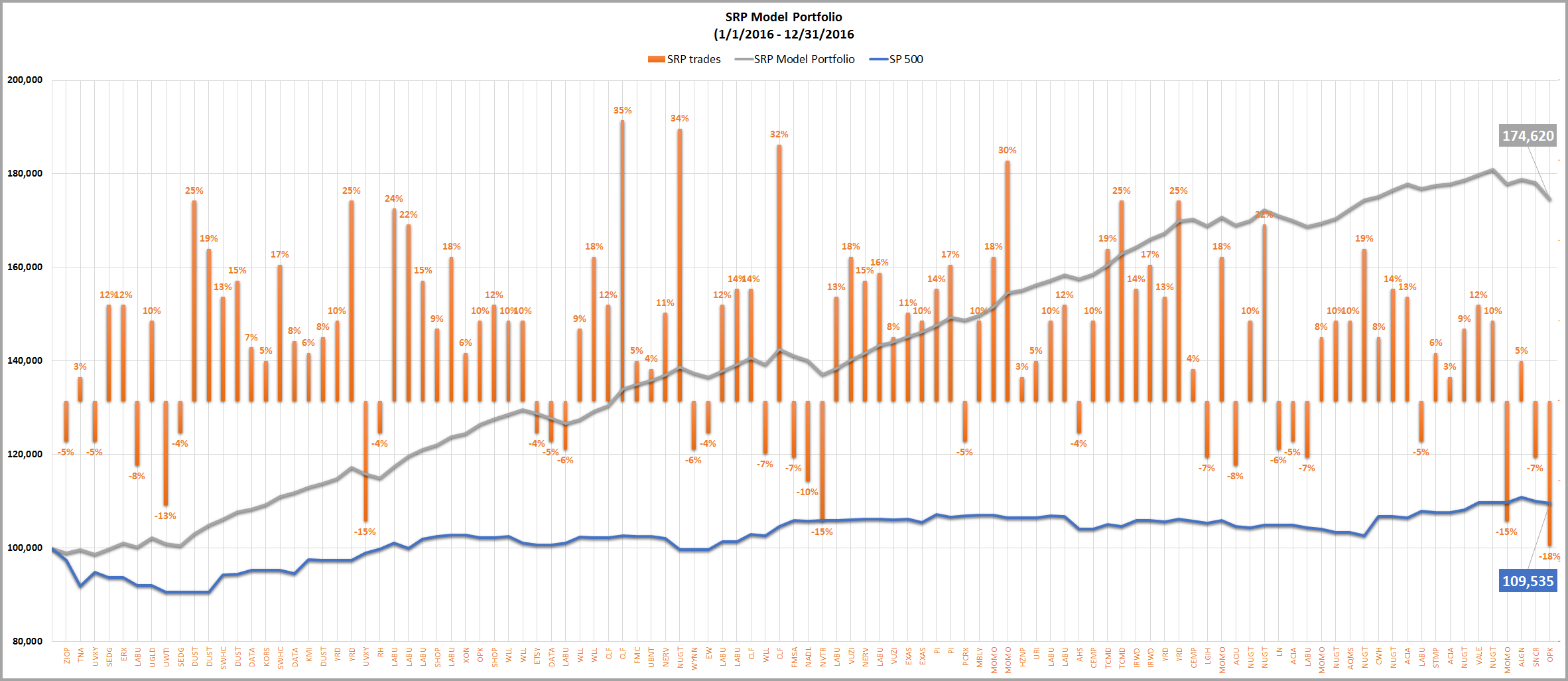

13 Mar 2016 Full Year Track Record

Below are the Closed Trade tables from our 2016 quarterly Track Record posts which you can also view on this Track Record Page. The 1st quarter 2016 was rough and we still had 20 winners and 9 losers. The Bear cycle was ending then after a strong drop in the SP 500 and a 30% drop in the small caps from highs to lows of early 2016. We crushed the market for the full year.

4th Quarter Closed Trades

| DATE | SIZE | SYMBOL | RETURN |

| 3-Oct | 0.50 | CEMP | 4.00% |

| 7-Oct | 1.00 | LGIH | -7.00% |

| 10-Oct | 0.50 | MOMO | 18% |

| 12-Oct | 1.00 | ACIU | -8% |

| 13-Oct | 0.50 | NUGT | 10% |

| 19-Oct | 0.50 | NUGT | 22% |

| 19-Oct | 1.00 | LN | -6% |

| 25-Oct | 1.00 | ACIA | -5% |

| 27-Oct | 1.00 | LABU | -7% |

| 31-Oct | 0.50 | MOMO | 8% |

| 1-Nov | 0.50 | NUGT | 10% |

| 1-Nov | 1.00 | AQMS | 10% |

| 2-Nov | 0.50 | NUGT | 19% |

| 15-Nov | 0.50 | CWH | 8% |

| 15-Nov | 0.50 | NUGT | 14% |

| 16-Nov | 0.50 | ACIA | 13% |

| 23-Nov | 1.00 | LABU | -5% |

| 30-Nov | 0.50 | STMP | 6% |

| 30-Nov | 0.50 | ACIA | 3% |

| 6-Dec | 0.50 | NUGT | 9% |

| 7-Dec | 0.50 | VALE | 12% |

| 7-Dec | 0.50 | NUGT | 10% |

| 7-Dec | 1.00 | MOMO | -15% |

| 21-Dec | 1.00 | ALGN | 5% |

| 28-Dec | 0.50 | SNCR | -7% |

| 30-Dec | 1.00 | OPK | -18% |

3rd Quarter Closed Trades

| 2016 | |||

| DATE | SIZE | SYMBOL | RETURN |

| 1-Jul | 0.50 | CLF | 14.00% |

| 7-Jul | 1.00 | WLL | -6.50% |

| 11-Jul | 0.50 | CLF | 32% |

| 14-Jul | 1.00 | FMSA | -7% |

| 15-Jul | 0.50 | NADL | -10% |

| 19-Jul | 1.00 | NVTR | -15% |

| 21-Jul | 0.50 | LABU | 13% |

| 25-Jul | 0.50 | VUZI | 18% |

| 26-Jul | 0.50 | NERV | 15% |

| 26-Jul | 0.50 | LABU | 16% |

| 27-Jul | 0.50 | VUZI | 8% |

| 1-Aug | 0.50 | EXAS | 11% |

| 2-Aug | 0.50 | EXAS | 10% |

| 15-Aug | 0.50 | PI | 14% |

| 16-Aug | 0.50 | PI | 17% |

| 19-Aug | 0.50 | PCRX | -5% |

| 23-Aug | 0.50 | MBLY | 10% |

| 23-Aug | 0.50 | MOMO | 18% |

| 24-Aug | 0.50 | MOMO | 30% |

| 24-Aug | 1.00 | HZNP | 3% |

| 24-Aug | 1.00 | URI | 5% |

| 7-Sep | 0.50 | LABU | 10% |

| 8-Sep | 0.50 | LABU | 12% |

| 14-Sep | 1.00 | AHS | -4% |

| 14-Sep | 0.50 | CEMP | 10% |

| 15-Sep | 0.50 | TCMD | 19% |

| 19-Sep | 0.50 | TCMD | 25% |

| 21-Sep | 0.50 | IRWD | 14% |

| 23-Sep | 0.50 | IRWD | 17% |

| 27-Sep | 0.50 | YRD | 13% |

| 28-Sep | 0.50 | YRD | 25% |

2nd Quarter Closed Trades:

| DATE | SIZE | SYMBOL | RETURN | 20000 | |

| 6-Apr | 0.50 | LABU | 24.00% | 2400.00 | 22,400.00 |

| 7-Apr | 0.50 | LABU | 22.00% | 2200.00 | 24,600.00 |

| 14-Apr | 0.50 | LABU | 15% | 1500.00 | 26,100.00 |

| 18-Apr | 0.50 | SHOP | 9% | 900.00 | 27,000.00 |

| 19-Apr | 0.50 | LABU | 18% | 1800.00 | 28,800.00 |

| 19-Apr | 0.50 | XON | 6% | 600.00 | 29,400.00 |

| 25-Apr | 1.00 | OPK | 10% | 2000.00 | 31,400.00 |

| 25-Apr | 0.50 | SHOP | 12% | 1200.00 | 32,600.00 |

| 27-Apr | 0.50 | WLL | 10% | 1000.00 | 33,600.00 |

| 29-Apr | 0.50 | WLL | 10% | 1000.00 | 34,600.00 |

| 6-May | 1.00 | ETSY | -4% | -800.00 | 33,800.00 |

| 6-May | 1.00 | DATA | -5% | -1000.00 | 32,800.00 |

| 11-May | 1.00 | LABU | -6% | -1200.00 | 31,600.00 |

| 25-May | 0.50 | WLL | 9% | 850.00 | 32,450.00 |

| 26-May | 0.50 | WLL | 18% | 1800.00 | 34,250.00 |

| 26-May | 0.50 | CLF | 12% | 1200.00 | 35,450.00 |

| 31-May | 0.50 | CLF | 35% | 3500.00 | 38,950.00 |

| 10-Jun | 1.00 | FMC | 5% | 900.00 | 39,850.00 |

| 10-Jun | 1.00 | UBNT | 4% | 800.00 | 40,650.00 |

| 22-Jun | 0.50 | NERV | 11% | 1100.00 | 41,750.00 |

| 24-Jun | 0.25 | NUGT | 34% | 1700.00 | 43,450.00 |

| 24-Jun | 1.00 | WYNN | -6% | -1200.00 | 42,250.00 |

| 24-Jun | 1.00 | EW | -4% | -800.00 | 41,450.00 |

| 29-Jun | 0.50 | LABU | 12% | 1200.00 | 42,650.00 |

| 29-Jun | 0.50 | LABU | 14% | 1400.00 | 44,050.00 |

1st Quarter Closed Trades: (Bear Cycle)

CLF for 16% Gains on a 5% position

3/29- Sold XRS for 4% Loss

3/23/16- Stopped out ZYNE for 10% Loss Full Position

3/18- Sold 1/2 XON for 9% Gains on Full Position

3/18- Sold 1/2 CLF for 25% Gains on a 5% Position

3/17- Sold RH for 4% Loss on Full Position

3/11- Sold UVXY for 15% Loss on 1/2 Position (7.5% equivalent loss on full)

3/10- Sold 1/2 YRD for 10% Gains;

3/10- Sold 1/2 YRD for 22-27% Gains

3/9- Sold DUST at 4.25 for 6-10% Net Gains (5% Position Size)

3/3: Sold KMI for 5-8% Gains

2/29: Sold 1/2 DATA for 7.5% Gains

2/26: Sold 1/2 DATA for 6.7% Gains

2/26: Sold KORS full position for 5% Gains

2/26: Sold final 1/2 SWHC for 17% Gains

2/24: Sold DUST (5% Position 1/2) for 15% Gains

2/17: Sold 1/2 SWHC for 12-15% Gains

2/10: Sold 1/2 DUST for 25% Gains

2/10: Sold 1/2 DUST for 19% Gains

2/9: Sold UWTI (5% Position 1/2) for 13% Loss

2/9: Sold 1/2 SEDG For 4% Loss

2/5: Sold LABU (5% Position 1/2) for 8% Loss

2/5: Sold UGLD ETF for 10% Gains

2/4: Sold 1/2 SEDG for 12% Gains, holding 1/2

2/4: Sold ERX 1/2 Position Size for 12% Gains

2/1- UVXY ETF, Loss of 5%

1/25: TNA 0-5% Swing Gains

1/6: Sold ZIOP for 5% Loss (Stopped out intra-day)